Critical Illness Insurance

Critical Illness Insurance

Critical illness insurance provides a crucial safety net for your family and finances by offering a lump-sum benefit upon diagnosis of a covered serious illness. This coverage ensures that you can focus on recovery without the added stress of financial burdens. It helps cover out-of-pocket medical expenses, daily living costs, or any other financial obligations, allowing you and your loved ones to maintain your standard of living during challenging times. With critical illness insurance, you gain peace of mind knowing that your family’s financial future is safeguarded, enabling you to concentrate on what truly matters—your health and well-being.

Highlights

- Covers Critical Illnesses & Cancers

- Guaranteed Issue

- Lump-Sum Benefit

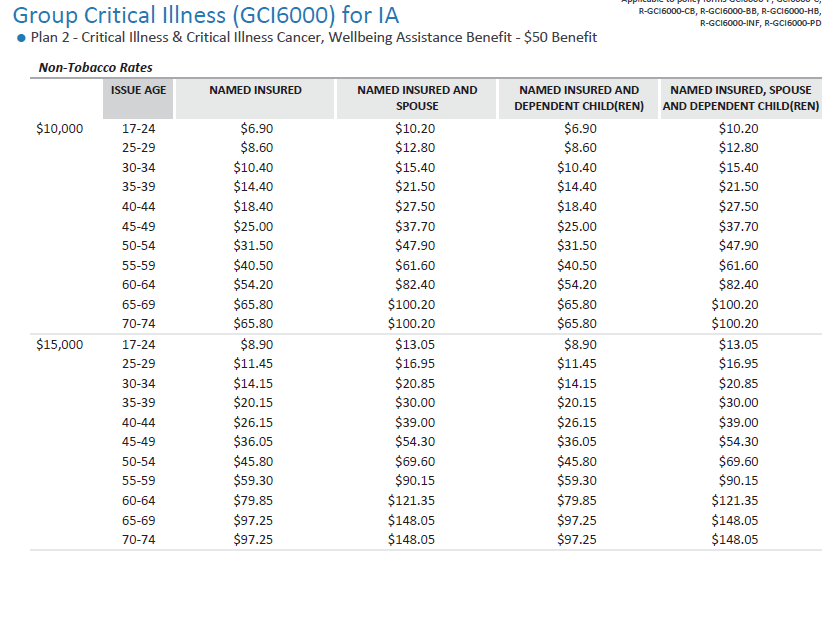

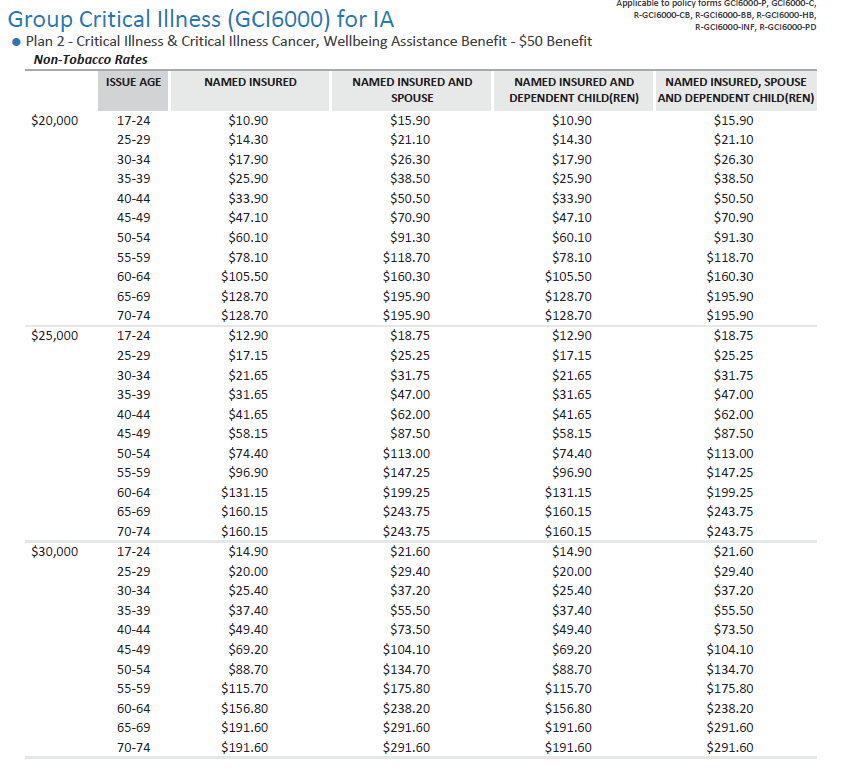

Critical Illness Insurance Rates:

This plan is portable which allows you to take it with you even when you no longer work at your position.

Coverage under this plan is guaranteed issue; no medical exams or tests are needed to enroll.

Colonial Life Group Critical Illness Insurance provides a lump-sum benefit if you are diagnosed with a covered critical illness, such as a heart attack, stroke, or major organ failure. This benefit helps cover medical and non-medical expenses, allowing you to focus on recovery without the added financial stress (Colonial Life) (Colonial Life)

Questions on your coverage?

Write an Email

Call Us

(515) 400 - 1011